A warning for debit card users

| Labels: America, culture and society, food for thought, useful things, written by Rio Denali | Posted On

written by Rio Denali

You aren't as safe as you think: Debit cards do not offer the same protections as a credit card.

Two weeks ago our bank account was hijacked at payday. Within hours our bank account was drained, and in cleaning up the mess we learned some surprising facts.

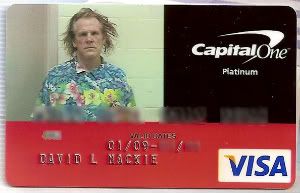

Like many people, we used our debit card for virtually everything: gas, groceries, restaurants; even to shop on-line. Really the breach could have happened anywhere, but in reviewing the time-line of our purchases we suspect that the debit card number was swiped electronically either from a stop at our local gas station, or by a fast-food employee at the drive-thru window.

Luckily our bank caught the breach within hours and de-activated my husband's debit card.

How did we find out? The most embarrassing way possible: his card was declined at the grocery store with a full cart of groceries.

How did we find out? The most embarrassing way possible: his card was declined at the grocery store with a full cart of groceries.Back at home, we discovered a phone message from our bank asking us to call about a possible security issue, and when we went on-line to view our account we discovered money missing.

In a matter of hours, thieves had taken hundreds of dollars. If our bank, USAA, had not protected us we would have been wiped out before the afternoon was over. (This is one of the many reasons we recommend banking with USAA if you are eligible.)

Legalities

Our bank did reimburse 100% of the stolen funds, but we were lucky; banks are not required to do so. With a credit card, liability for unauthorized purchases is capped at $50 no matter what, but with debit cards it is different. Debit cards only offer a $50 cap on liability if the unauthorized transactions are reported within 2 days. The liability goes up to $500 for reports of a lost or stolen card if made between 3 and 60 days. And you are fully liable for any transactions reported after 60 days from the bank statement date. Our bank reimbursed us for 100% of the stolen funds, but not all banks are so generous.

Advantages of using Credit Cards vs. Debit Cards:

Purchase Protection

All credit cards offer special purchase protections. These protections vary by card, generally are free, and most people do not even know they exist. They are especially beneficial when it comes to on-line or large purchases, but some benefits apply to even the smallest of charges.

Some credit card companies take it a step further and offer free purchase insurance that will refund in the event of loss, theft, or breakage. Details of the insurance will vary by company, and most have a minimum purchase amount.

And, many credit cards offer free insurance on car rentals, and some even offer trip insurance for airline tickets.

And, many credit cards offer free insurance on car rentals, and some even offer trip insurance for airline tickets.Reversing or Disputing a Transaction

One of the most powerful benefits of using a credit card over a debit card is the ability to reverse or dispute a transaction. If you order an item that does not arrive, or you receive something other than what you ordered, you can dispute the transaction with your credit card company who will resolve the issue on your behalf.

Paypal

If you use Paypal, you are only fully protected if you fund the transaction with a credit card. Paypal offers a free"Buyer's Protection Plan", however upon reading the fine print you will discover that the reimbursement is limited. Paypal decides if and when reimbursement should occur at all (you agreed to this when checking boxes to open your account). And, the fine print also states that the buyer's protection coverage is limited to the amount recoverable from the other person's Paypal account. If their Paypal account is empty, you get nothing.

However by funding the Paypal transaction with a credit card, you have the full protection of your credit card company behind you and retain all rights to dispute the charge should something go wrong with the transaction. This will allow you to receive FULL reimbursement, whereas using a debit card only offers the protection that Paypal deems sufficient.

Smart Advice

The smartest advice is to not use a debit card, but for most of us that is not realistic. However, a great alternative is to open a second account, which you fund with only the amount needed for day-to-day purchases. Do not link your debit card to an account with a lot of money; this limits the amount a thief can get hold of.

The smartest advice is to not use a debit card, but for most of us that is not realistic. However, a great alternative is to open a second account, which you fund with only the amount needed for day-to-day purchases. Do not link your debit card to an account with a lot of money; this limits the amount a thief can get hold of.Obviously we have learned our lesson, not to use a debit card linked to the same account that our paycheck is deposited into. Even though our bank reimbursed us, it did take 8 days to get the money back. Imagine an emptied bank account and mortgage being due, or credit card payments being late. We were lucky, but an attack such as this could reek havoc on a person's credit. A missed or bounced payment could lead to various charges including late or returned payment charges, insufficient funds charges, and even losing promotional interest rates on credit accounts, not to mention endless headaches and sleepless nights.

It is impossible to prevent card number theft in this current electronic age, however by using a credit card in place of a debit card for purchases can greatly reduce your exposure to risk and provide you with added benefits.

- Want to reprint this article?

- Please be our guest as long as you include this complete blurb with it:

- This article was originally featured on RioDancesOnTheSand.com, a blog for the thinking person... Written by Rio Denali, a 30-something with peculiar curiosities, who makes the observations that many of us avoid. Full of useful links and entertaining articles, it is a fun favorite for the intelligent reader. For more great articles like this, please visit RioDancesOnTheSand.com.